January Las Vegas Market Report

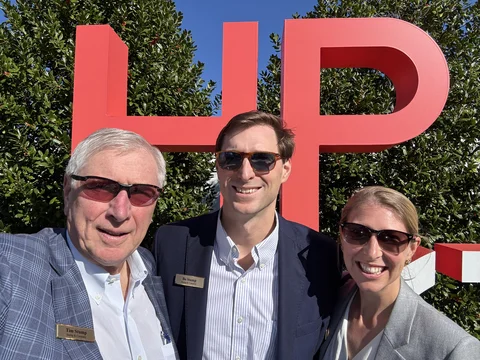

2026 is off to a bustling start with the Las Vegas Market, held twice a year at the World Market Center in downtown Vegas. The Stump team showed up a day early to beat the ice storms back home on the East Coast (but unfortunately didn’t score tickets to the Eagles at the Sphere!). It’s on our list for the next trip.

Market Highlights

- Partner Stuart Stump Mullens won the WithIt Young Leader award, and we are very proud of her accomplishments. We were amazed at the talent level at the banquet and feel positive about the leadership of our industry for years to come.

- Attendance was lighter than usual, unfortunately, due to the storms and its significant impacts on travel for most of the country.

- Attitudes were generally positive, as most companies are seeing modest uptick in business over last year and seeing signs of growth. Clearly, the higher end / designer driven market is outperforming the lower-priced promotional sectors of the market.

- The lower floors at the Market are driving regional business year-round, making Vegas a desirable destination for the high end. We heard several tenants describing frequent visits from designers locally and from as far away as Los Angeles to work in their showrooms. It’s great to hear these spaces are being leveraged outside of Market!

- Bedding remains vibrant in the B building. Ultimately, the three buildings seem to have too much square footage for the furniture industry alone, with empty floors and spaces evident. Hopefully other complementary industry tenants will move in over the coming years to fill the footprint.

- Tariffs remain a key topic, however most suppliers are learning to adapt to the ever-changing landscape. Retailers are basically accepting whatever comes. And everyone is hoping for more clarity - and less trauma - in the future.

- Mortgage rates are ticking down slowly, and it seems the Fed will be more dovish later in the year under new leadership. Interest rate relief would be a welcome in our industry, which is so tied to housing. The Fed is watching!

Quote of the Market #1: “There is a fork in the road for our industry and the strong are moving forward and the weak are getting off the road and going home,” opined one optimistic and strong performing CEO.

Quote of the Market #2: “It’s a knife fight out there at retail,” opined one tired sales rep. His colleague overheard this and suggested he get a machete for the fight!

Our Merger & Acquisition business is hitting on all cylinders as we are benefitting from this fork in the road of strong vs weak. Strong companies see this time as an opportunity to pick up product lines, sales channels and key management talent. Weaker companies want to exit due to owners’ ages (yes, the baby boomers) or just get out of running a business in a challenging environment.

Quote of the Market #3: “It’s just not as fun as it used to be running a business,” suggested one older CEO.

Broader Market M&A Trends

- Core vs. Non-core: as we said with our announcement of the sale of Samual Lawrence and Pulaski Furniture to Magnussen Home, Hooker Furnishings (the seller) made it clear they are focusing on higher-end goods, and by exiting those brands are freed up to spend more time and deploy incremental capital for their core business moving forward. Expect to see more of this type of activity.

- Manwah’s acquisition of Southern Motion/Fusion ended the PE ownership of these great domestic brands. Expect to see more PE exits this year given the longer than usual hold times and improving market conditions. We also expect more China/Asia acquisitions of domestic upholstery operations.

- Mexico remains an area of focus for many furniture executives due to the availability of skilled labor (think sewing) and affordability versus US production. And close proximity to the US Market. Border towns like Juarez and Tijuana are benefitting, as well as the interior cities like Monterrey, Saltillo, Torreon and Matamoros. There is still some uncertainty on the USMCA agreement that is up for review later this year.

- Technology continues to play a key role in the industry’s development, with AI everywhere, increased talks about robots and digital printing, and more connectivity with IT/ERP/CRM systems to make the customer experience better.

Our backlog is full and we expect to make more M&A announcements soon. Please call us with your thoughts. Remember the quote from late last year: “Let’s get rich in ’26!”

May it be so.

Related News

BDNY Market Recap

BDNY Market Recap

Fall 2025 High Point Market Recap

Fall 2025 High Point Market Recap

NeoCon & Design Days Recap 2025

NeoCon & Design Days Recap 2025

Everyone Loves Green: M&A on Display in Nashville